The Price Paradox

As luxury fashion houses like Chanel, Louis Vuitton, and Hermès continue to hike prices—often at double the rate of inflation—savvy investors are turning their attention to a booming alternative: secondhand luxury platforms and local, independent brands offering unique, authentic products. We have to start by understanding what is the Veblen Goods Curve.

As luxury fashion houses like Chanel, Louis Vuitton, and Hermès continue to hike prices—often at double the rate of inflation—savvy investors are turning their attention to a booming alternative: secondhand luxury platforms and local, independent brands offering unique, authentic products. We have to start by understanding what is the Veblen Goods Curve.

Veblen Goods: Veblen goods are luxury goods that are not purchased primarily for their utility or practical value, but rather for their ability to display wealth and status. Examples include designer handbags, luxury watches, sports cars, and fine wines.

Higher Costs, Unchanged Classics

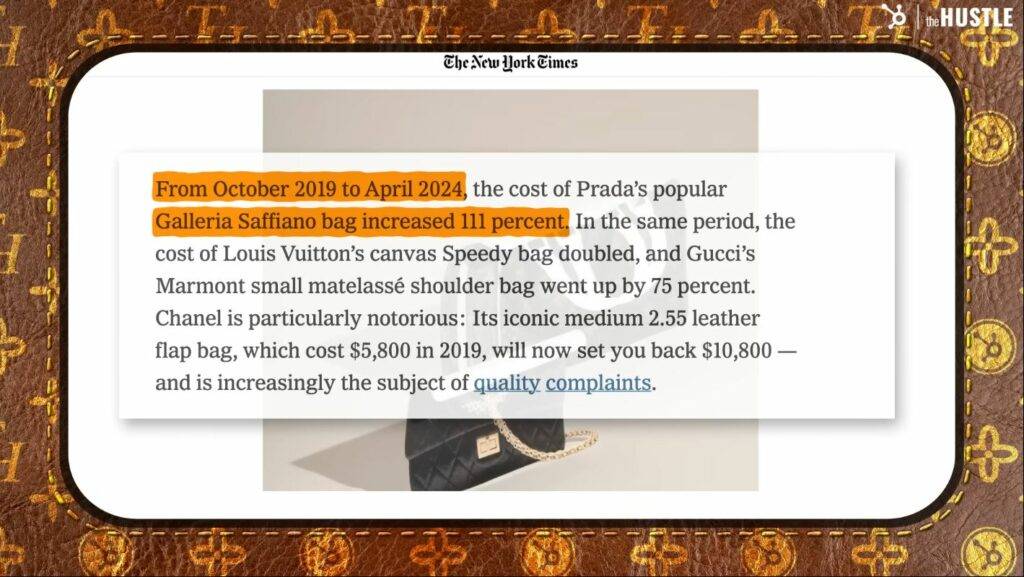

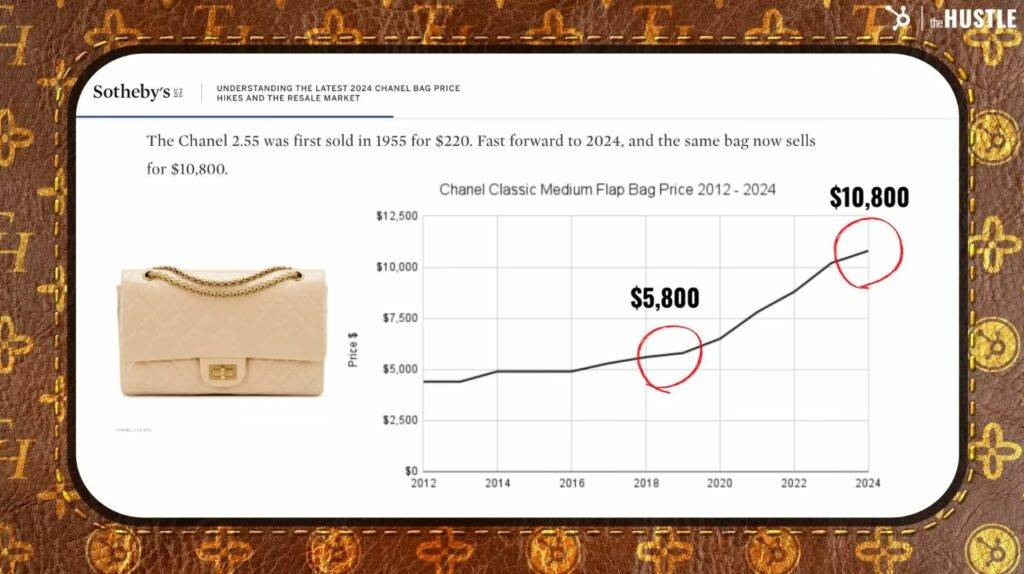

Over the past several years, iconic luxury items—especially handbags and watches—have seen price tags rise dramatically, sometimes by over 80% since 2019. What’s striking is that many of these products have remained virtually unchanged in design and materials, yet their cost to consumers continues to climb. This aggressive pricing strategy, while boosting exclusivity, is increasingly putting new luxury goods out of reach for many buyers and fueling demand for alternatives.

Luxury brands have been increasing prices every year and how this will continue to trend as luxury product companies have been increasing prices double the rate of inflation

Some hand bag products have appreciated so much it has surpasses having had the money invested in the S&P for the past two years. So who said your wife’s bag would of appreciated more than that classic Ferrari in your garage.

Why Luxury Fashion Brands Are Struggling in 2025

Luxury icons like Louis Vuitton, Gucci, and Chanel are facing a surprising downturn in sales across their two most important markets: the United States and China. While these brands have long been symbols of exclusivity and high quality, recent trends reveal that even the world’s wealthiest consumers are rethinking their purchases.

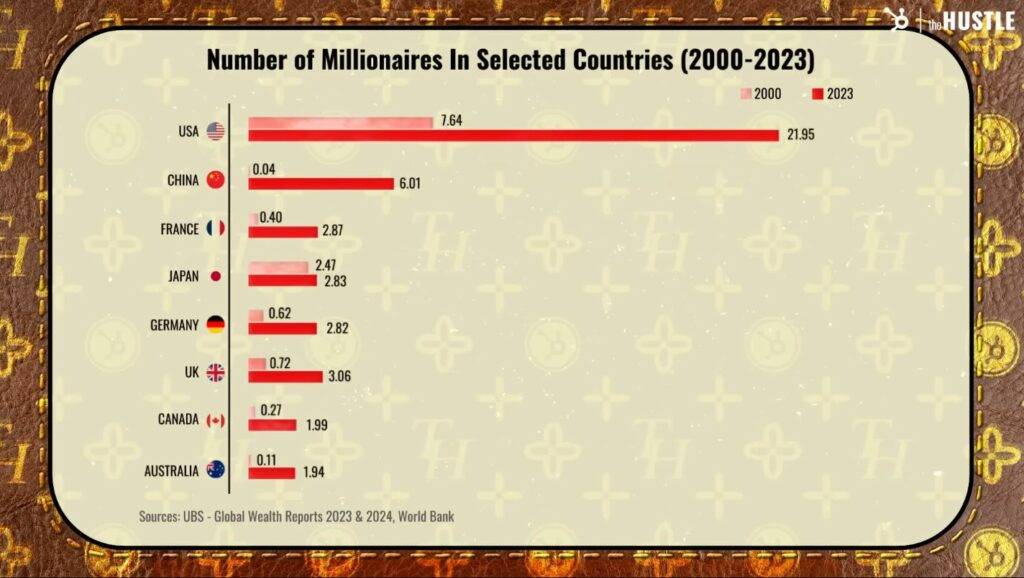

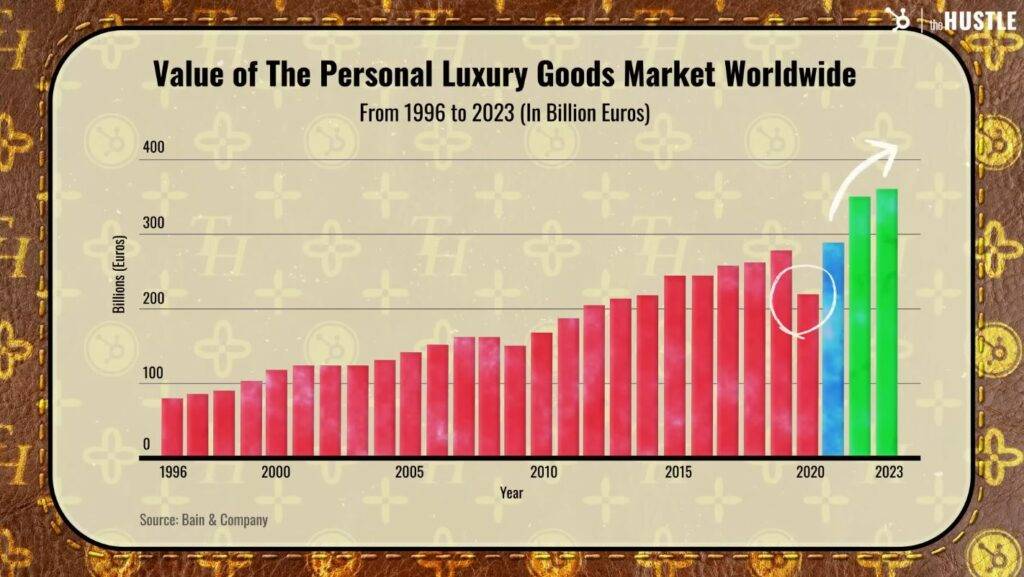

This chart illustrates the explosive growth in the number of millionaires across major economies from 2000 to 2023, with the United States and China leading the surge. Despite this dramatic increase in global wealth, luxury brands are facing new challenges as affluent consumers shift their preferences.

What’s Behind the Decline?

Over the past two years, the luxury industry has lost 50 million consumers, and only a third of the sector is showing any growth. This is despite the fact that, globally, there are more millionaire households than ever before. So, why aren’t they buying?

Upward-Sloping Demand Curve: Unlike most goods, where demand decreases as the price rises, the demand for Veblen goods increases as the price increases. This is because a higher price is perceived as a sign of exclusivity and quality, making the good more desirable.

The answer is complex, but several key factors stand out:

-

- Soaring Prices: From 2019 to 2025, prices for iconic items like Chanel’s Classic Flap bag have increased by as much as 86%, far outpacing inflation. This aggressive price strategy, without corresponding improvements in quality or innovation, has left many consumers feeling alienated.

-

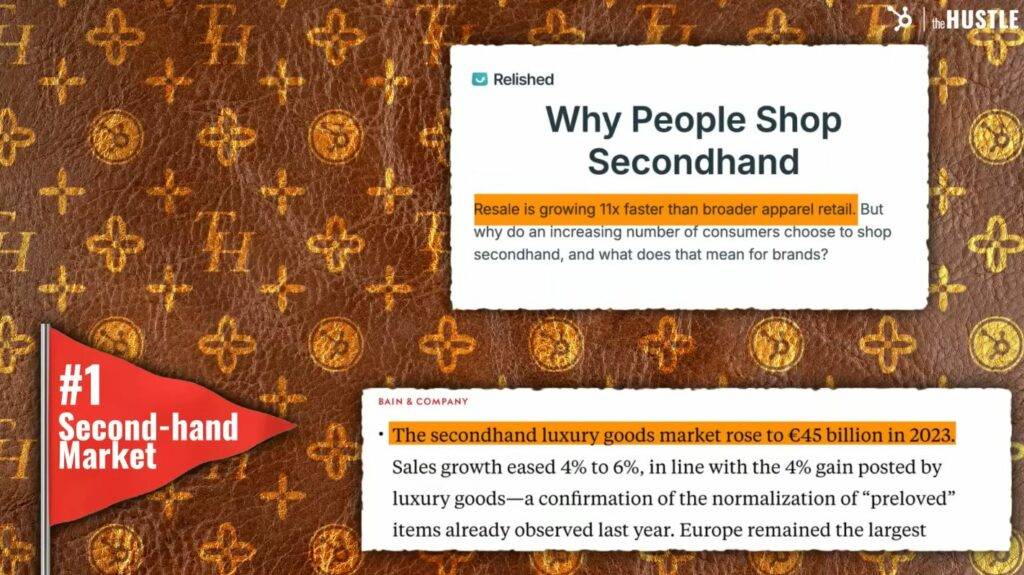

- Changing Tastes: Younger buyers, especially Gen Z, are leading a shift toward secondhand and vintage luxury goods. The secondhand luxury market hit $47 billion in 2023, thanks to a growing preference for sustainability, uniqueness, and value.

-

- Brand Fatigue and Quality Concerns: Years of relying on classic designs and loud logos, combined with perceived dips in quality, have led to “brand fatigue.” Many consumers now seek out smaller, boutique brands that offer authenticity and craftsmanship.

Origin of term, Brand Fatigue: Michael Kors during New York Fashion week. Who said there is nothing new to be learned every day.

Who’s Winning?

Not all luxury brands are struggling. Hermès, for example, has thrived by keeping its products scarce and refusing to chase trends, posting double-digit growth in 2024. Meanwhile, up-and-coming labels and secondhand platforms are capturing market share by catering to new consumer values.

The Secondhand Surge

Enter the secondhand luxury market. Once niche, this sector is now one of the fastest-growing segments in global fashion. The market is expected to reach $64 billion by 2025, expanding at a compound annual growth rate of 10–15%47. Online platforms like The RealReal, Vestiaire Collective, and Fashionphile are thriving as consumers seek access to coveted brands at 30–70% less than retail prices8. Authentication technology and the circular economy movement have further legitimized the space, attracting both value-seekers and collectors hunting for rare or discontinued pieces234.

A trend that began with Gen Z and is continued to be replicated among newer generations, you know how Vintage is becoming a trend, and the saying: They don’t manufacture things with the same quality or soul as before…

Local, Niche, and Independent Brands: The New Luxury

At the same time, there’s a growing appetite for boutique labels and independent designers who offer limited-edition, artisanal, or sustainable products. Younger consumers, in particular, are driving this trend, seeking out brands that deliver authenticity, craftsmanship, and a story—qualities sometimes lost in mass-market luxury24. These brands are often more agile, eco-conscious, and responsive to changing tastes than their global counterparts.

Enter the secondhand luxury market. Once niche, this sector is now one of the fastest-growing segments in global fashion. The market is expected to reach $64 billion by 2025, expanding at a compound annual growth rate of 10–15%47. Online platforms like The RealReal, Vestiaire Collective, and Fashionphile are thriving as consumers seek access to coveted brands at 30–70% less than retail prices8. Authentication technology and the circular economy movement have further legitimized the space, attracting both value-seekers and collectors hunting for rare or discontinued pieces234.

These are two major markets for this company which continues to expand to other markets such as the Asian market.

Mercari is one of those companies you might want to keep an eye on due to it’s increase of revenue year after year in the second hand goods industry.

Investment Outlook

The convergence of rising luxury prices and shifting consumer values is creating a unique investment window. Secondhand luxury platforms are scaling rapidly, fueled by technology and a new generation of buyers. Meanwhile, niche and independent labels are capturing market share by delivering what modern luxury consumers want most: uniqueness and meaning.

For investors, this means opportunity:

Secondhand platforms are poised for sustained growth as price-conscious and eco-aware shoppers flood the market.

Local and independent brands offer exposure to the next wave of luxury, where authenticity and scarcity drive demand.

As traditional luxury houses continue their price hikes, expect the secondhand and independent segments to shine even brighter in the years ahead.

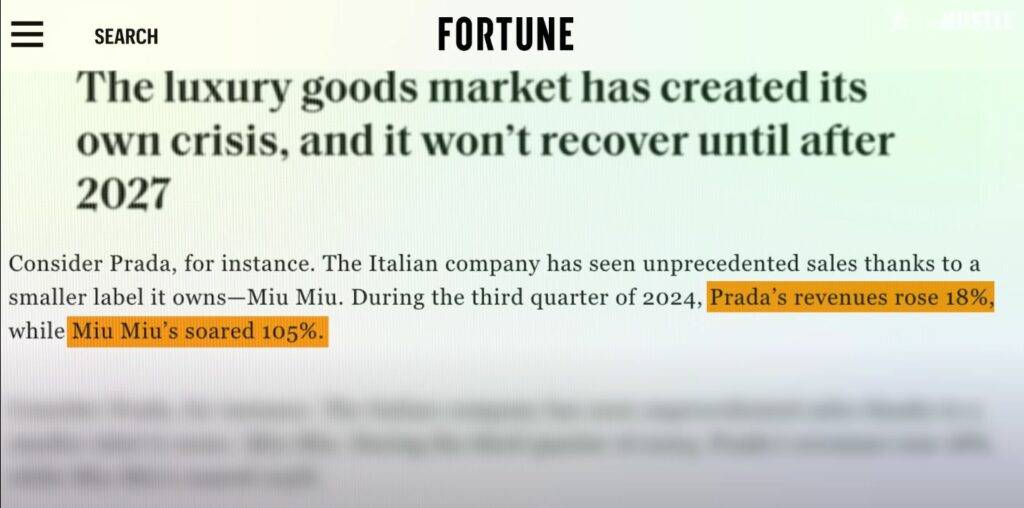

“How Luxury Giants Are Winning Back Market Share Through Sister Brands and Emerging Fashion Labels”

In response to shifting consumer preferences and the surge of small, independent fashion businesses, major luxury houses are increasingly diversifying their portfolios by launching new sister brands and sub-labels. For example, Prada has found major success with Miu Miu, which has developed its own identity and cult following, helping to drive impressive growth for the Prada Group even as legacy luxury brands face headwinds24.

This strategy allows established players to capture younger, trend-driven audiences and experiment with fresh aesthetics without diluting their core brand. If you’re interested in learning more about the emerging brands capturing market share from the traditional giants, be sure to download our PDF featuring 10 high-grossing small fashion brands that are redefining the luxury landscape.

NOTE: Want to read more about how trends and consumer behavior are reshaping global markets.

For more insights on market trends and investment opportunities, follow our News section or subscribe to our newsletter.